tax deduction malaysia 2019

19 November 2019 Published by Inland Revenue Board of Malaysia Second edition First edition on 28 February 2013. If your chargeable income after tax reliefs and deductions does not exceed RM35000 you will be granted a rebate of RM400 from your tax charged.

Solar Tax Incentive Yongyang Solaroof Solar Energy Roofing Malaysia

Donations are only tax deductible if they are made to a Government approved charitable organisation or directly to the Government.

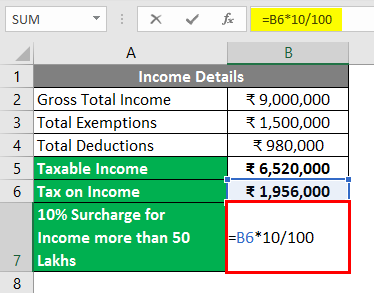

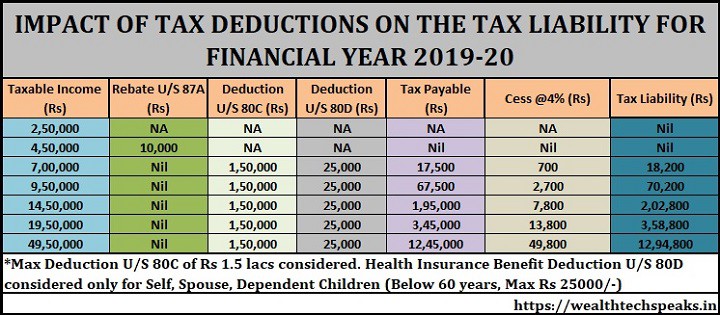

. Malaysia at the time of sale of the taxable goods. 2019 to 31 December 2019. Therefore the taxpayer can claim a standard deduction of Rs.

A tax rebate directly reduced your amount of tax charged and there are currently four types of tax rebates for income tax Malaysia YA 2019. Discover Helpful Information And Resources On Taxes From AARP. And you must keep the receipt of the donation.

The legislation dealing with the general deduction is stated in Section 33 1 of the ITA. Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any. Updates and Amendments 32 13.

If your chargeable income after tax reliefs and deductions does not exceed RM35000 you will be granted a rebate of RM400 from your tax charged. Reduction of corporate tax rate for small medium enterprises SMEs on chargeable income of up to RM 500000 to 17 from 18 effective from YA 2019. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund.

Simple PCB Calculator. DatachildNo Tax Resident. Within 1 year after the end of the year the payment of withholding tax is made.

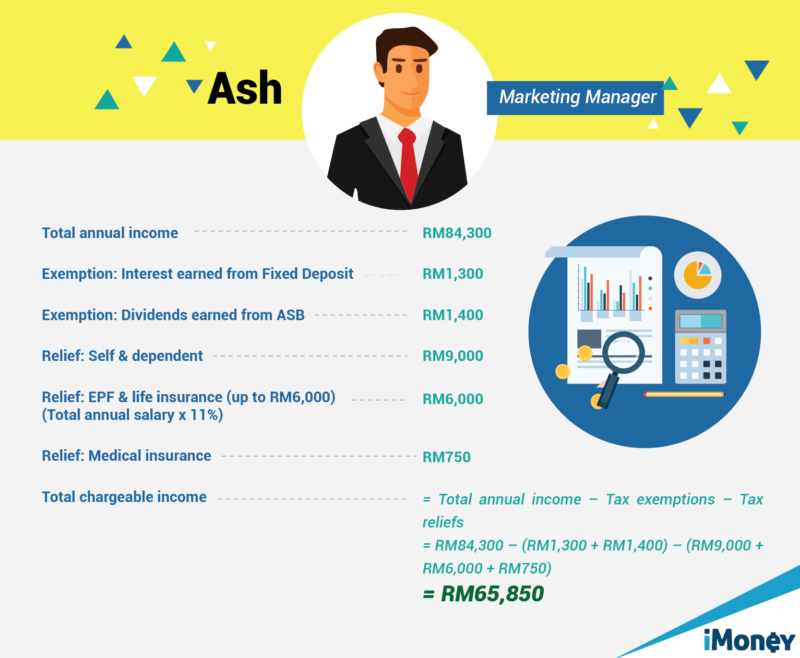

Monthly Tax Deduction 2019 for Malaysia Tax Residents optionname00 Allowance Bonus0000 - Allowance Bonus. Increased to Rs 50000 for FY 2019-2020 AY 2020-21 through the. A tax rebate directly reduced your amount of tax charged and there are currently four types of tax rebates for income tax Malaysia YA 2019.

Assessment Year 2018-2019 Chargeable Income. A sales tax deduction in the form and manner as prescribed section 41A2A of Sales Tax Act 2018. The Guide on Sales Tax Deduction Facility as at 9 August 2019 is withdrawn and.

Effective from YA 2019 to YA 2021 Tax deduction on expenses incurred by companies participating in the National Dual Training System Training Scheme for the I40 program approved by the Ministry of Human. In a recent clarification issued by the income tax department if a taxpayer has received a pension from the former employer it is taxable under the head Salaries. Income tax deductions for contributions made to any social enterprise subject to a maximum of 10 of aggregate income of a company or 7 of aggregate income for a person other than a company.

40000 or the amount of pension whichever is less. For example if your chargeable income is RM55000 and youve donated RM2500 to an approved charitable organisation you are allowed to deduct 7 of. 52019 INLAND REVENUE BOARD OF MALAYSIA Date of Publication.

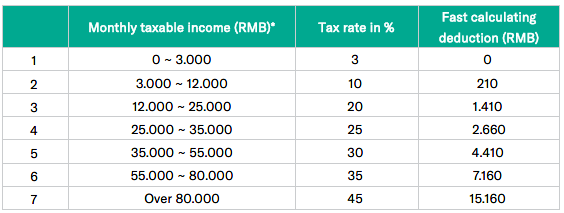

Calculations RM Rate TaxRM 0 - 5000. Tax rebate for self. The key issue that one should pay attention when claiming a tax deduction is whether the expenditure is wholly and exclusively incurred in the production.

On the First 5000. Deduction Claim By Employers 31 12. Tax rebate for self.

20182019 Malaysian Tax Booklet Income Tax. On the First 5000. Tax rebate for.

Calculate your Monthly Tax Deduction PCB and view your net salary at one glance with this minimalist Simple PCB Calculator. Further tax deduction for employers hiring senior citizens or ex-convicts Further deduction will be given to employers on remuneration paid to full-time employees who are senior citizens aged above 60 years old or ex-convicts provided the monthly remuneration does not exceed RM4000. Page 1 of 32.

On the First 5000 Next 15000. Tax deduction not claimed in respect of expenditure incurred that is subject to withholding tax which is not due to be paid on the day the return is furnished. Summary of Highlights of Malaysia Budget 2019 - Budget 2019 themed - A Resurgent Malaysia A Dynamic Economy A Prosperous Society.

Where the Director General approves the application for a sales tax deduction. Tax is governed strictly by tax laws which in Malaysia is principally the Income Tax Act 1967 ITA. Monthly Tax Deduction MTD 31 11.

With A Longer Mco Tax Filing Deadline Should Be Further Extended Ctim Malaysian Institute Of Estate Agents

Donation Tax Deduction Malaysia 2018 Savannagwf

Should You Invest In Sspn Mypf My

Earning Stripping Rules Malaysia Lhdn Thk Management Advisory Sdn Bhd Johor Malaysia Newpages

Laws Of Malaysia Income Tax Regulations

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

How To Calculate Income Tax On Salary On Sale 58 Off Www Ingeniovirtual Com

Donation Tax Deduction Malaysia 2018 Savannagwf

Highlights Of Malaysia Budget 2019 Summary Of Tax Measures

Should You Invest In Sspn Mypf My

Taxplanning So You Want To Start Your Own Business The Edge Markets

St Partners Plt Chartered Accountants Malaysia Lhdn Latest Public Ruling Public Ruling No 10 2019 Withholding Tax On Special Classes Of Income The Objective Of This Public Ruling Is To

2019 Income Tax Calculator Hotsell 54 Off Pwdnutrition Com

2019 Income Tax Calculator Cheap Sale 60 Off Www Ingeniovirtual Com

Highlights Of Malaysia Budget 2019 Summary Of Tax Measures

How To Calculate Income Tax On Salary On Sale 58 Off Www Ingeniovirtual Com

How To Calculate Income Tax On Salary On Sale 58 Off Www Ingeniovirtual Com

Comments

Post a Comment